Did you know that the ticker symbol for the first company ever traded on the New York Stock Exchange was WATER? It represented the Shawnee Water Company and was traded in 1792. This is surprising because today, the stock market is often associated with high-tech companies and industries, making the origins of the exchange with a water company seem unlikely.

Anyway, the stock market has grown to such a massive scale that no one really thinks about its origins. What’s more important for beginners is to learn stock market basics, and here is what every new trader should know:

Start with a solid education

Before putting any money in the stock market, it’s essential to have a good understanding of the basics of finance and trading, as well as the stock market itself. This education should cover topics such as how to read financial statements, how to analyze a company’s financial performance, and how to use technical analysis to make informed decisions.

Set clear goals

When trading in the stock market, it’s important to have a clear understanding of why you are trading and what you hope to achieve. Determine your trading goals and how the stock market fits into your overall financial plan. Some of the bigger goals can be saving for retirement, generating income, or building capital over time.

Consider your risk tolerance

It’s important to assess your risk tolerance as this can help you make informed decisions about which types of assets are right for you. For example, if you have a low risk tolerance, you may want to consider assets that are more conservative, such as bonds or index funds. Those with a higher risk tolerance may be more interested in growth stocks or emerging market investments.

Create a diversified portfolio

Make sure you educate yourself on stock market basics for beginners, such as different types of assets, so that you can cover more stocks and sectors. This means not putting all your eggs in one basket but instead spreading your investments to mitigate risk.

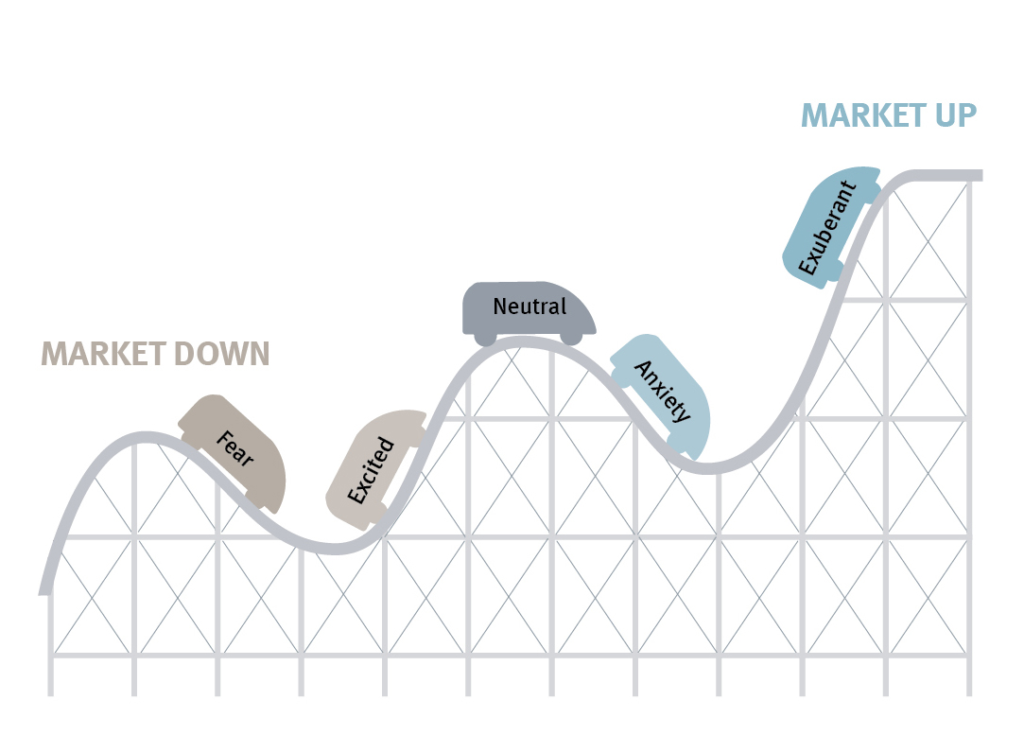

Keep emotions in check

The stock market can be volatile, and emotions can easily get the best of even experienced traders. Fear and greed are two of the biggest emotional traps in trading, leading to impulsive buy and sell decisions that can negatively impact your portfolio. So, it’s helpful to take a step back and assess the situation objectively before making any trades.

Don’t buy based on rumors

The stock market is full of speculation and misinformation, and acting on rumors can lead to poor decisions. Focus on financial statements, analyst reports, and any other relevant information. It’s also wise to pay attention to credible news sources and expert opinions, but always take any news with a grain of salt and don’t make decisions based solely on hearsay.

Keep a long-term perspective

The stock market can be unpredictable in the short term, with prices fluctuating daily, but over time, it has consistently delivered positive returns. By focusing on the long-term potential of your trades, you can avoid making impulsive decisions based on short-term market swings.

Regularly monitor and review

It’s important to regularly reassess your trading strategy to ensure it still aligns with your financial goals and risk tolerance. Consider scheduling regular review sessions, whether that’s weekly, monthly, or quarterly, to ensure you’re on track to meeting your trading objectives.

Consider the fees

Every time you buy or sell an asset, you may incur fees such as brokerage fees, exchange fees, and other miscellaneous charges. These fees can quickly add up and eat into your profits, so it’s important to understand the costs associated with your trades.

Keep it simple

Here are some key points to follow when keeping it simple in trading:

- Avoid over-complicating your portfolio. Diversification is important, but too many holdings can make it difficult to manage risk.

- Focus on a limited number of assets. Specialize in a few markets or products that you are familiar with and understand well.

- Use straightforward trading strategies. Complex strategies can be difficult to execute and understand, increasing the risk of making mistakes.

Having stock market basics explained is just the first step on a long journey of learning and development. To become successful in the stock market, you need to continually research, analyze, and educate yourself about the market and the companies you are investing in.

Sources:

How to set your investment goals, The Motley Fool

Why it’s important to diversify your investing portfolio, TIME

What is risk tolerance and why is it important? Bankrate

Keep your day trading simple: here’s how to do it, The Balance Money