People have misunderstood the brain for thousands of years. Ancient Egyptians thought it was useless, Aristotle thought it was a radiator that kept the heart from overheating. Now that neuroscientists can peer inside a human skull, there are more answers. And yet, not everybody understands how to master the mind and trade rationally.

This article will explain how to train your rational self to stay in control.

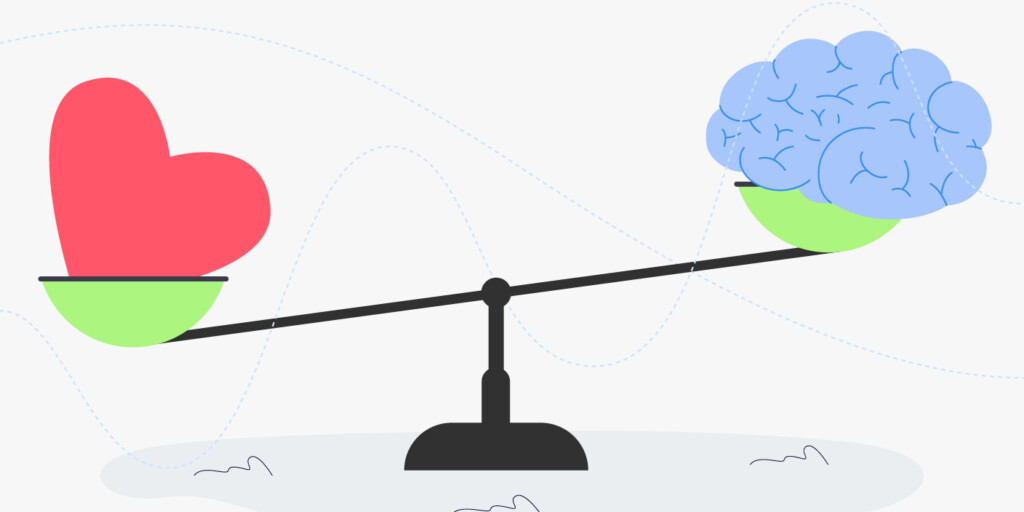

Trading intellectually vs. trading emotionally

Some people are natural thinkers, so they’re less at risk of trading emotionally, i.e., from a place of greed, pride, etc. But other people feel their emotions very deeply. Despite being an intelligent, experienced trader, such a person can be driven to make irrational decisions. That is something the market doesn’t tolerate.

A good trader perceives everything through the lens of knowledge. For example, when Yahoo Finance reports on a company’s lacking financials, they don’t panic sell that company’s stock. They gather what else they know about the company, analyze industry trends, and try to project what the economic outlook may be in the next quarter. And then they decide to sell or hold.

Signs you think with your heart, not your head

Here is what characterizes someone who thinks with their heart:

- Even when you try to hide your emotions, something always gives you away.

- Dishonesty and injustice make you feel extremely angry or sad.

- You are more attuned to other people’s emotions and start feeling whatever they’re feeling.

- You have big dreams of changing the world one day or leaving a lasting legacy.

- You start your sentences with “I feel like…”.

- When you’re doing something creative or artistic, you don’t let anything or anyone disturb you.

- You are unpredictable.

- You have a love-hate relationship with your rational self.

How to get into the right trading mindset

For those looking for effective self-regulation strategies, here are five practices to try.

Get into a routine

Most importantly, don’t change the rules between trades or mid-trade. Even if something’s not going quite as expected, stay on track.

Also, structure your day in a specific way to minimize unpredictability, uncertainty, and stress, at least in your personal life. Try to come up with an effective ritual of your own.

Recognize when your emotions intrude

Some things become bigger stressors than you realize. If you struggle with catching and holding back your emotions, try to improve your emotional awareness (or some call it emotional intelligence). That means naming your emotions, recognizing emotions in others, and acknowledging your triggers, along with other techniques.

Focus on what you can control

A “trading brain” doesn’t bother trying to control market conditions. It doesn’t mean that these conditions are non-urgent or unimportant. But you can only do well if you center your attention on the present moment and your direct impact on it. Put simply, don’t mind the downtrend, mind your next move.

Don’t obsess over small things

On a small timescale – like hourly and daily charts – there is a lot going on and a lot of buy and sell pricing signals. But if you pay too much attention to them, you’ll just be inviting emotions.

Get used to occasional losses and unfriendly market conditions.

Keep an open mind

Philosophy professor William Hare says that open-mindedness is an intellectual virtue that reveals itself in a willingness to revise ideas and meet the ideals of objectivity and impartiality. In a way, that is what this whole article is about – trying to achieve objectivity and impartiality.

A word of caution: Carl Sagan wittingly noted that you shouldn’t be “so open that your brains fall out.”

Takeaway

It’s normal not to feel like yourself during unusual or volatile times. But you shouldn’t wait for the market to go back to normal since you can put yourself in a worse situation in the meantime. Essentially, if you can’t think clearly, you can’t trade.

Sometimes, your trading brain just needs a few fixes in the form of a checklist and some rules. From paying attention to your emotional responses to being able to adapt.